The sale allows both parties to strengthen specific capabilities thereby keeping customers as the singular focus. Infor’s overlap of EAM and ERP customers is relatively small Hexagon needed a solid EAM foundation to expand its asset performance capabilities and Infor is able to provide that. We want to remain focussed on what we do well and that is ERP,” said Somasundaram.

“To be really good at something takes a lot of time. According to, Somasundaram the rationale behind the sale is two-fold. Infor remains determined to provide excellence to its customers and it goes without saying that this deal was thoughtfully orchestrated with customer experience front of mind. “Infor does ERP really well and Hexagon does asset performance really well – we believe that Hexagon is a good home for our EAM business,” said Somasundaram.Īlthough the transaction is yet to complete, the total deal value is close to $2.7bn – with $800m in cash and the balance in shares giving Koch (Infor’s owners) a 5 percent stake in Hexagon.

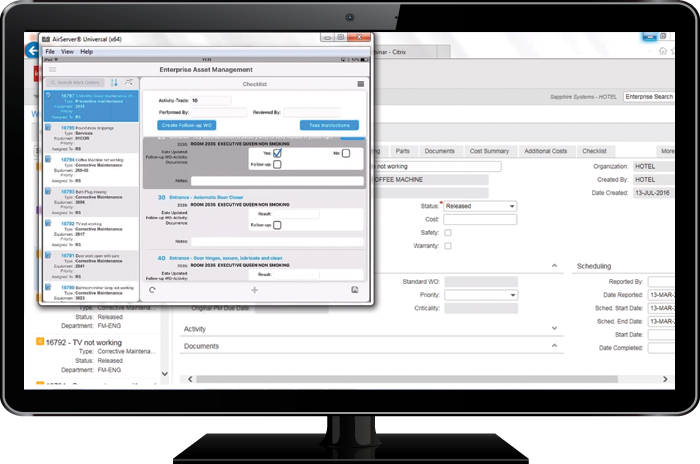

When ERP Today met with Soma Somasundaram, chief technology officer and president of products at Infor, we had one burning question – why sell a profitable business unit when Infor is still in a growth phase? When Infor announced its intention to sell its enterprise asset management (EAM) business to Hexagon, a digital reality solutions company, we immediately thought, why? It can’t be about the money – despite the astronomical sale price, Infor is owned by Koch Industries, one of the best capitalised enterprises in the world.

0 kommentar(er)

0 kommentar(er)